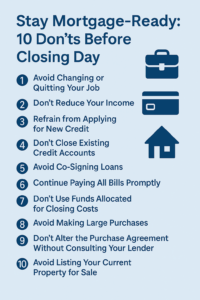

Navigating the final stages of securing a mortgage can be both exciting and nerve-wracking. Even after receiving a mortgage approval, certain missteps can jeopardize the closing process. To ensure a smooth transition to homeownership, here are ten critical actions to avoid between your mortgage approval and the actual closing.

1. Avoid Changing or Quitting Your Job

Lenders prioritize stability. Switching jobs or altering your employment status—such as moving from full-time to part-time—can raise red flags. Even if the new position offers a higher salary, probationary periods or changes in income consistency can lead lenders to reassess or even revoke your mortgage approval.

2. Don’t Reduce Your Income

Any decrease in income can affect your debt-to-income ratio, a key metric lenders use to assess your ability to repay the loan. Maintaining consistent income ensures that your financial profile remains favorable in the eyes of the lender.

3. Refrain from Applying for New Credit

Opening new credit accounts or taking on additional debt can negatively impact your credit score and debt-to-income ratio. These changes can make you appear riskier to lenders, potentially leading to higher interest rates or loan denial.

4. Don’t Close Existing Credit Accounts

While it might seem prudent to close unused credit cards, doing so can reduce your available credit and increase your credit utilization ratio. This shift can lower your credit score, affecting your mortgage terms.

5. Avoid Co-Signing Loans

Co-signing a loan makes you legally responsible for the debt. This obligation increases your liabilities, which can alter your financial profile and potentially disqualify you from your mortgage.

6. Continue Paying All Bills Promptly

Timely bill payments are crucial. Late payments can significantly impact your credit score, which lenders monitor up until the closing date. A drop in your score can lead to unfavorable loan terms or denial.

7. Don’t Use Funds Allocated for Closing Costs

Lenders expect you to have sufficient funds to cover closing costs, typically around 1.5% of the purchase price. Using these funds for other expenses can jeopardize your ability to close the deal.

8. Avoid Making Large Purchases

Purchasing big-ticket items like furniture or appliances on credit can increase your debt load and affect your credit score. It’s advisable to postpone significant purchases until after the mortgage has closed.

9. Don’t Alter the Purchase Agreement Without Consulting Your Lender

Any changes to the purchase contract, such as price adjustments or added contingencies, can affect your mortgage approval. Always discuss potential modifications with your lender before making them official.

10. Avoid Listing Your Current Property for Sale

If your mortgage approval is contingent upon retaining your current residence, listing it for sale can complicate or nullify your loan agreement. Ensure that any decisions regarding your existing property are communicated and approved by your lender.

Final Thoughts

The period between mortgage approval and closing is critical. Maintaining financial and employment stability during this time is essential to ensure a successful home purchase. Always consult with your mortgage advisor before making significant financial decisions to avoid jeopardizing your loan approval.

If you have further questions or need personalized advice, feel free to ask!